Mindset for Rappers

Mindset for Rappers How to Change Your Rapper Name

Know Why You’re ChangingDecide why your current name no longer fits, maybe you want a fresh start or to avoid negative a...

Mindset for Rappers

Mindset for Rappers  Beat Selling Site

Beat Selling Site  Beatmaker Mindset

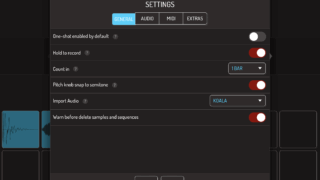

Beatmaker Mindset  Koala Sampler

Koala Sampler  AI Diary

AI Diary  Koala Sampler

Koala Sampler  Site Creation

Site Creation  Music Diary

Music Diary  Plugins

Plugins  Web3

Web3  Mindset for Rappers

Mindset for Rappers  Rap/Vocals

Rap/Vocals  Suno

Suno  Suno

Suno  Suno

Suno  Beatmaking with AI

Beatmaking with AI  Beatmaking with AI

Beatmaking with AI  Beatmaking with AI

Beatmaking with AI  Beatmaking with AI

Beatmaking with AI  Beatmaking with AI

Beatmaking with AI ![[Emotional Rap Experimental Beat] Genx Beat 20250222 21 20250222](https://genxnotes.com/wp-content/uploads/2025/07/20250222-320x180.jpg) Emotional Hiphop Beats

Emotional Hiphop Beats ![[Boombap Experimental Beat] Genx Beat 20250221 22 20250221](https://genxnotes.com/wp-content/uploads/2025/07/20250221-320x180.jpg) Boombap Hiphop Beats

Boombap Hiphop Beats ![[Dark Experimental Beat] Genx Beat 20250220 23 20250220](https://genxnotes.com/wp-content/uploads/2025/07/20250220-320x180.jpg) Dark Hiphop Beats

Dark Hiphop Beats ![[Emotional Hiphop Beat] Promise - Genx Beats 24 Promise](https://genxnotes.com/wp-content/uploads/2022/09/Promise-320x180.jpeg) Emotional Hiphop Beats

Emotional Hiphop Beats ![[Happy Hiphop Beat] Tell Me What You Want - Genx Beats 25 Tell Me What You Want](https://genxnotes.com/wp-content/uploads/2022/09/Tell-Me-What-You-Want-320x180.jpeg) Happy Hiphop Beats

Happy Hiphop Beats ![[Emotional Hiphop Beat] Peace - Genx Beats 26 Peace scaled 1](https://genxnotes.com/wp-content/uploads/2022/08/Peace-scaled-1.jpeg) Emotional Hiphop Beats

Emotional Hiphop Beats ![[Emotional Hiphop Beat] Warm Heart - Genx Beats 27 Warm Heart scaled 1](https://genxnotes.com/wp-content/uploads/2022/08/Warm-Heart-scaled-1.jpeg) Emotional Hiphop Beats

Emotional Hiphop Beats ![[Emotional Hiphop Beat] Home - Genx Beats 28 Home](https://genxnotes.com/wp-content/uploads/2022/09/Home-320x180.jpeg) Emotional Hiphop Beats

Emotional Hiphop Beats ![[Emotional Hiphop Beat] Sweet Summer - Genx Beats 29 Sweet Summer scaled 1](https://genxnotes.com/wp-content/uploads/2022/08/Sweet-Summer-scaled-1.jpeg) Emotional Hiphop Beats

Emotional Hiphop Beats ![[Emotional Hiphop Beat] Scarlett - Genx Beats 30 Scarlett](https://genxnotes.com/wp-content/uploads/2022/09/Scarlett-320x180.jpeg) Emotional Hiphop Beats

Emotional Hiphop Beats